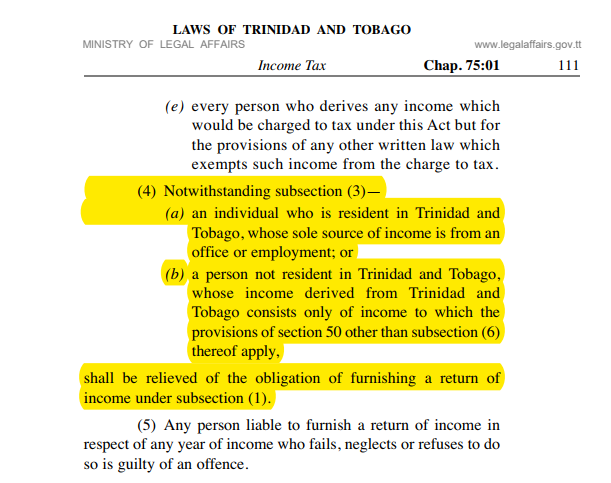

For those of us who are old enough to remember there was a point in time when all employees in Trinidad and Tobago were mandated by Law to file Income Tax returns, annually. This law was amended in, 2002 removing the requirement for Emolument Income individuals, (persons whose only income is from their salaries) to file Income Tax Returns.

The reason being, employers are responsible for deducting their employees’ taxes and remitting it to the State so there is no need for employees to stress themselves about taxes…Great news, Right?!!

Well, kind of…

The inherent benefit that employees derived from being required to file Tax returns previously, was, the process caused the employee to double-check the taxes their employer deducted from their salaries during the year to ensure that no mistakes, which negatively impacted them were made. Additionally, employees were more keenly in tuned to the various tax incentives that they were allowed to capitalize on.

But seeing that employees are no longer required to file and the topic of taxes is somewhat unappealing, most employees simply have a general idea of what their “take-home” salary amounts are and once the figure doesn’t deviate too far from that…then…Hakuna Matata!!

Well, something to consider is that although salaries are for the most part the same amount weekly, forth-nightly or monthly, there are things that happen during the year which may impact these payments. These include; pay increases, bonus-payments, job-changes and overtime…just to name a few. These things would impact the tax calculation that the payroll department needs to make. Sometimes, it may get tricky and lead to mistakes. One such mistake can be…you are taxed more than you should be.

Additionally, there may even be tax incentives that you are entitled to but you did not informed your employer and as such you don’t receive the benefit

Solution – Once a year, when you get your TD4 slip, redo the calculations to ensure that the taxes you paid for the year are no more than what you were legally required to pay. Use this Tax Calculator for assistance

Another practical suggestion would be that you seek assistance from someone who offers Tax Preparation Services. This person would be able to guide you and give you advice specific to your situation. Simple Tax TT is one such service geared specifically for Employees, where you can get advice.

The main point is…Yes your employer is responsible for deducting your taxes but it’s YOUR responsibility to double-check that your money is correct and you’re not being over taxe